Financial stability in balance, risks remain

Financial stability in the Netherlands has been buoyed in recent months by an improving economy and upbeat sentiment in financial markets, following a brief period of turbulence in the summer. Steadily falling inflation in the euro area and a ‘soft landing’ of the economy contribute to stability. However, geopolitical uncertainty is increasing, as is the risk of cyberattacks, and both pose a threat to financial stability. These developments are detailed in the Financial Stability Report, which De Nederlandsche Bank (DNB) published today.

Published: 21 October 2024

© ANP

Risks are never far off

DNB Executive Board member Olaf Sleijpen said: "The Dutch financial sector is in good shape, but risks are never far off. There is geopolitical turmoil, economic uncertainty is high, and cyberattacks pose an increasing threat. Financial stability risks also stem from budget deficits and high public debts in many countries.''

Banks are in good shape

The profitability of Dutch banks has increased in recent years, and both their capital buffers and their liquidity positions are solid. Banks have an average capital ratio of 16.3%, and their profits – despite a projected decline – are expected to remain at healthy levels for the time being. So far, economic uncertainty has translated into a limited increase in credit losses. Although corporate insolvencies in the Netherlands have been on the rise in recent months, they are still below the pre-pandemic average, and so far there has only been a small rise in non-performing loans.

Increased interest rate protection

Insurance firms and pension funds are also financially sound. In light of higher interest rates in recent years and in the run-up to the new pension system, Dutch pension funds have increased their average interest rate protection from 37% to 64% over the past years, reducing the negative impact of declining interest rates.

Cyber risks are on the rise

Cyberincidents pose a growing threat to society and the financial sector, due in part to digitalisation and geopolitical tensions. Cyberattacks are carried out not only by criminal hacker groups, but also by other countries. Moreover, the cyberlandscape is becoming increasingly complex, due in part to the rise of artificial intelligence (AI). AI offers opportunities, for example in the fight against cyberattacks, but at the same time hackers are also using AI to carry out more frequent and sophisticated attacks.

Vital processes

On top of that, the financial sector is vulnerable to incidents that occur at third parties, as services such as cloud storage are outsourced to a small group of service providers. Dependence on telecom services for vital processes also plays a role. Nowadays, a quarter of all cyberattacks in the world affect the financial sector. These can be direct attacks on financial institutions or indirect threats through external parties or suppliers. It is important that financial institutions thoroughly understand these vulnerabilities, share information to mitigate cyber risks and prepare crisis measures. Society should also be aware that a cyberattack could, in extreme cases, make financial services temporarily unavailable.

Mounting government debts also affect financial institutions

In the Netherlands, government debt is low at 46% of gross domestic product, well below the euro area average of 89%. But the Netherlands and other euro countries are pursuing an accommodative fiscal policy for the time being, and public debts continue to rise. This could affect financial stability. If debts are high, governments have less headroom to support the economy. In addition, highly indebted countries are more susceptible to a reversal in financial market sentiment caused, for example, by rising geopolitical tensions. Financing costs for these governments rise on average four times faster after a geopolitical shock than is the case for low-debt countries.

Sensitive to problems in other euro area countries

If public debt in the Netherlands rises to high levels over time, the Netherlands may also become vulnerable to these risks. In addition, the Dutch financial sector is sensitive to problems in other euro area countries. For instance, turbulence in financial markets about debt sustainability elsewhere can cause financing costs to rise and the assets of Dutch financial institutions to lose value. For example, Dutch pension funds and insurance firms hold about 5% of their assets in debt securities of euro area countries with debts higher than 90% of GDP. It is therefore important for the Netherlands that the European Commission enforces the new rules of the Stability and Growth Pact for all euro countries.

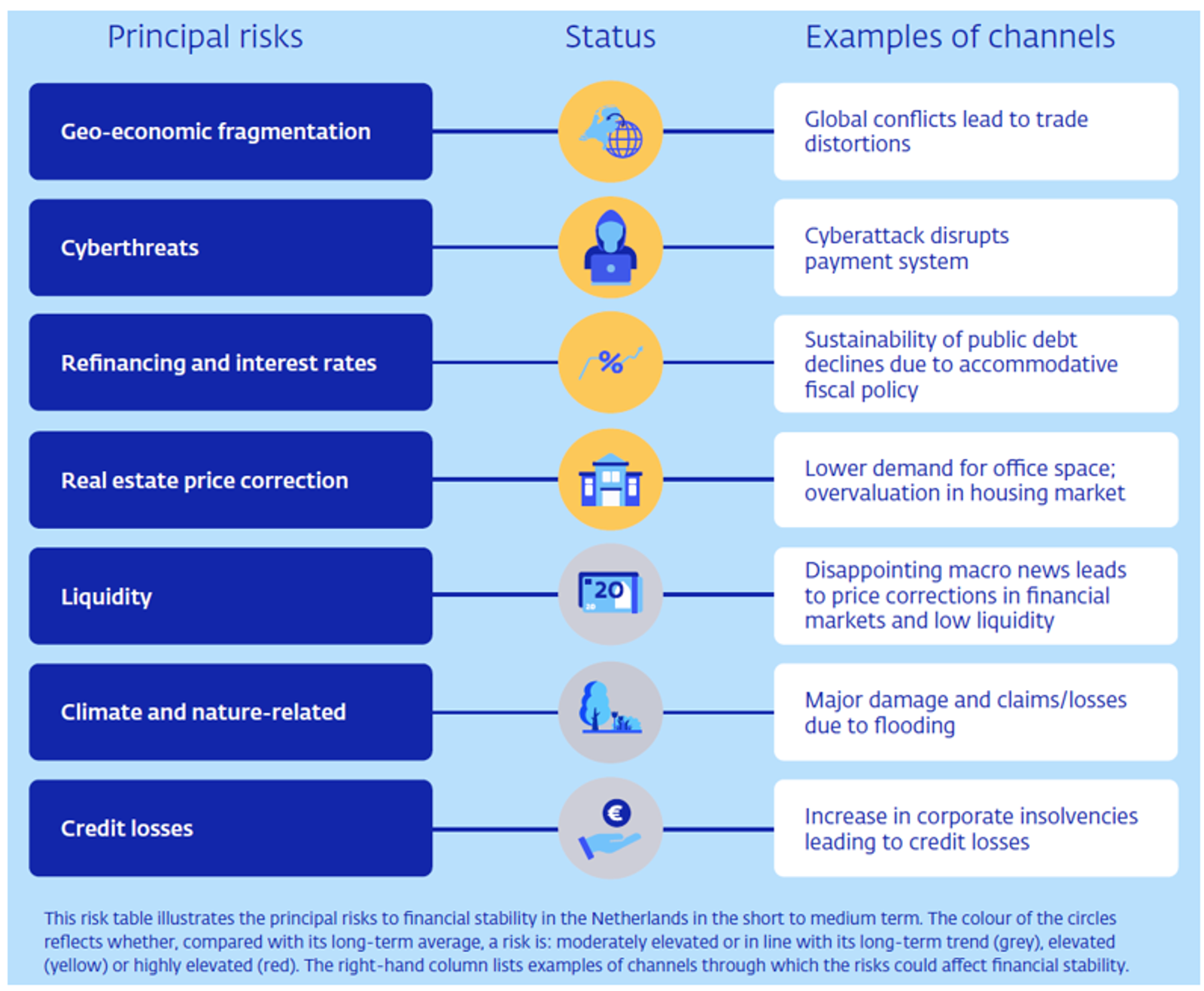

Risk table illustrating financial stability in the Netherlands

© DNB

Media representatives can contact Bouke Bergsma by email at bouke.bergsma@dnb.nl or by telephone at +31 653 258 400.

Introductory remarks at press conference Financial Stability Report

Financial Stability Report - Autumn 2024

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.